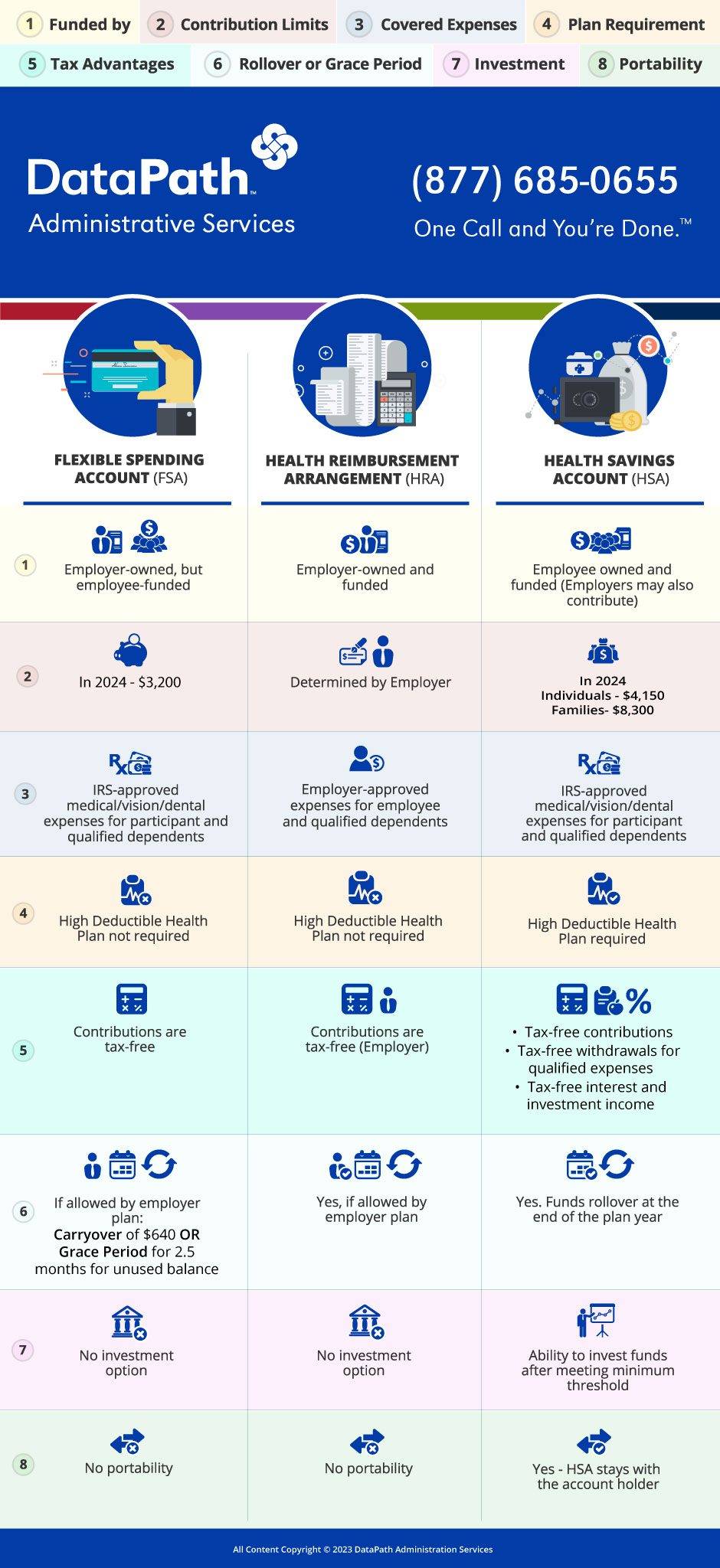

When it comes to FSA vs. HRA vs. HSA, can you tell the differences? Each has a distinct purpose. Below is a quick overview and helpful infographic that compares specific features of each type of account.

Three consumer-directed healthcare (CDH) benefit accounts offer tax advantages. They include Flexible Spending Accounts (FSAs), Health Reimbursement Arrangements (HRAs), and Health Savings Accounts (HSAs).

While these accounts bear some similarities, they are not the same. Employers sponsor all of them, and they all offer tax advantages, help offset the cost of medical care, and help individuals take more control of their healthcare. However, beyond that, there are striking differences.

FSA vs. HRA vs. HSA: The Overview

Flexible Spending Account (FSA)

Funding: FSAs are owned by the employer. Participants contribute the funds, although employers may choose to contribute.

Contributions: Participants reduce their tax liability by making pre-tax contributions. For 2024, the maximum annual election will be $3,200 for healthcare FSAs and $5,000 for DCAPs (Dependent Care Assistance Plans), often offered alongside healthcare FSAs.

Eligible Expenses: Participants can use FSA funds to pay for a wide range of out-of-pocket medical expenses approved by the IRS. Eligible purchases include copays, deductibles, and coinsurance for medical care, prescriptions, eye exams, eyeglasses/contacts, dental care, first aid supplies, over-the-counter (OTC) medications, and more.

Unused Funds: There are three options to address unused funds at the plan year’s end. Each plan adopts one of the three as chosen by the employer.

- ‘Use It or Lose It’ – Leftover funds are forfeited to the employer.

- 2.5-Month Grace Period – Extra time is provided to spend the funds.

- Carryover – Participants carry over a certain amount of unused funds to the next plan year; for 2024, the carryover limit will be $640.

Portability: FSAs are not portable. The employer owns the accounts, so participants cannot keep them if they change employers (voluntarily or involuntarily) or retire.

Other Important Facts: FSAs are “notional” accounts. That means participants must incur an eligible expense before administrators process a reimbursement. A significant advantage to the participant is that the funds do not need to accrue before use. The total annual election amount is available to spend immediately after the plan year starts.

Health Reimbursement Arrangement (HRA)

Funding: HRAs are owned and funded by the employer only.

Contribution Limits: There is no government-mandated limit on funding. The employer determines the amount each year. Since the employer is the sole contributor, there are no contribution tax breaks for the employee. However, employer contributions are not counted as income to the employee-participant.

Eligible Expenses: Employee participants can use their HRA to pay for qualified out-of-pocket medical expenses for themselves and their dependents. HRA-qualified expenses are determined by the employer and may vary from one company to the next.

Rollover: Unused funds may roll over from year to year, either in total or up to a certain amount, depending on the plan parameters.

Portability: HRAs are not portable. An employee-participant loses access to the funds if he or she changes employers (whether voluntarily or involuntarily). Employers who offer retiree health insurance benefits may also offer an HRA for former employees enrolled in the retiree health plan.

Other Important Facts: HRAs are “notional” accounts, meaning the participant must incur a qualified expense before funds are paid out. Self-employed persons are generally ineligible to have an HRA. However, if the self-employed person’s spouse is considered an employee of the business and receives a W-2 paycheck, then the spouse can have an HRA.

Health Savings Account (HSA)

Funding: HSAs are owned by the employee (although some employers also choose to contribute).

Contribution Limits: For 2024, the maximum annual election is $4,150 for employees with individual health coverage and $8,300 for those with family coverage.

Eligible Expenses: Employee participants can use their HSA to pay for the same IRS-approved out-of-pocket medical expenses as FSAs. In addition, HSA owners can use their funds to pay premiums for COBRA, long-term care, and Medicare Parts A and B.

Plan Requirement: To be eligible to contribute to an HSA, the employee-participant must be enrolled in an HSA-qualified high-deductible health plan (HDHP).

Unused Funds: The account automatically renews at the plan year’s end, and any unused funds roll over to the next year.

Portability: HSA accounts, being individually owned, stay with the employee-participant for the life of the account, no matter their employment status.

Other Important Facts:

- HSAs offer three tax advantages. Contributions are deducted from payroll before tax calculations. Withdrawals for qualified expenses are tax-free. Interest on the balance and any investment earnings are also tax-free.

- Account owners may invest their HSA dollars once they meet the minimum balance threshold required by their plan provider.

- Account owners over age 55 can make an extra “catch-up” contribution of up to $1,000 per year above the annual limit.

- HSA owners under age 65 incur both income tax and non-qualified withdrawal penalties. However, when they turn 65, funds used or withdrawn for non-eligible expenses are only considered regular income for tax calculations.

FSA vs. HRA vs. HSA: The Infographic